Expense Management Software: Take Control of Your Finances

In financial management, keeping track of expenses is crucial for maintaining fiscal health and maximizing efficiency. Enter expense management software is a powerful tool designed to streamline the process of recording, categorizing, and analyzing expenses for individuals and businesses alike. Expense management software offers a centralized platform to capture receipts, track spending, and generate reports, providing invaluable insights into where money is being allocated and how budgets can be optimized. In this blog post, we’ll delve into expense management software, exploring its features, benefits, and the transformative impact it can have on managing finances effectively. Whether you’re a freebie tracking business expenses or a finance manager overseeing corporate budgets, understanding the capabilities of expense management software is essential for making informed financial decisions and achieving long-term financial goals.

Understanding Expense Management Software

Expense management software processes, yields, and audits employee-starting charges. Employees can submit expenses for approval using the software’s website or mobile app. Expense management software automates and streamlines a company’s expense entry, eliminates paper trails, and reduces administrative effort. It gives managers total insight and tracking of employee use of company funds.

Expense management software analyzes total expenses, discovers cost-cutting options, and regulates overspending.

A product must meet the following criteria to be considered for inclusion in the Expense Management category:

Allow for data entry.

Have an automated system for tracking, controlling, and reporting spending.

Connect to existing accounting and administrative systems

Examine your expenses before submitting them.

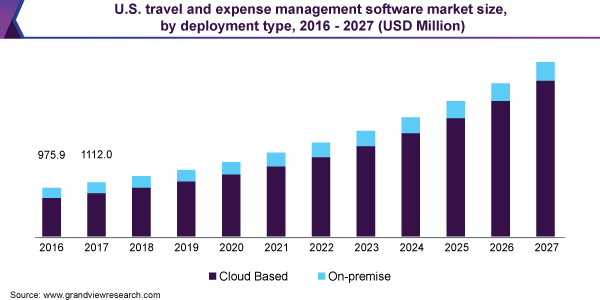

Source- Grand View research

Top Expense Management Software

Today’s markets are filled with a deluge of user-friendly expenditure management systems that fulfill various critical responsibilities. To ensure l er expenditure, precisely prepared cost reports, and timely payment of dues, a business requires comprehensive expense management software.

In this post, we’ll examine some of the top expenditure management tools on the market today. The following list was compiled based on our own experiences with the tools. After thoroughly assessing them for their features, cost, and convenience of use, we can safely recommend them.

1) Paramount WorkPlace

Today’s market is filled with user-friendly expenditure management systems that fulfill various critical responsibilities. These include, but are not limited to, invoice management, expense tracking, receipt management, spend and approval process control, and workflow management.

An organization needs powerful expense management software to ensure lower expenditures, precisely prepared cost reports, and timely dues payment.

In this post, we will examine some of the top expenditure management tools on the market today. The list below was compiled based on our experiences with the tools. After thoroughly researching the tools’ features, cost, and ease of use, we can safely recommend the names below.

Pros:

Approvals and Entry via Mobile

Receipt capture with sophisticated OCR

ERP Integrations in Real Time.

Real-time integration with OFX-supporting banks

Cons:

Slow interface

2) Airbase

Airbase provides cloud-based expenditure management software, which is great for complete visibility into your workforce’s spending. The software was created to assist businesses in managing their expenses. It achieves his purpose through tools such as real-time reporting, corporate virtual cards, and bill payment automation.

Airbase provides virtual and corporate cards. Employees can use any of these cards to make purchases under company standards. You are notified of every activity involving employee spending and can take measures to curb spending, thus preventing unnecessary costs.

Pros:

Corporate and virtual credit cards

Workflow approval processes should be automated.

Reporting in real-time

Integrates with third-party platforms such as Xero, NetSuite, and others.

Cons:

Poorer quality

3) DivvyPay

Divvy provides a platform for tracking your costs across many platforms in a single, unified dashboard. The platform gives you tools to easily track, manage, and control your business spending. Divvy allows for rapid reconciliation, so you are notified promptly when employees spend.

With a few clicks on your mobile device, you can rapidly capture expense data that interests you, analyze transactions, and approve them. Vvy’s best feature is its virtual card. This provides you with real-time insight into your employees’ spending. You are immediately informed if there is an overspend or overspending. You can also instantly freeze this virtual card.

Pros:

Real-time expense tracking

Automatically categorize transactions

Employees can be reimbursed.

Examine your spending.

Cons:

Unable to integrate with accounting software

Also read: How to Avoid Project Cost Overrun? Best Tips and Guidelines to Follow

4) Zoho Expense

Zoho Expenditure provides an unrivaled expense management experience thanks to one of the most intuitive dashboards on this list. Zoho is widely regarded as an excellent management tool, providing solutions that ease different parts of a company’s operations. It is the gr latest small company that uses management software.

You will gain detailed insights into all submitted and outstanding reports, the reimbursement amount, and data about undetected expenses. This totool’saanalyticsomponent is likely its most appealing selling feature. It provides a detailed breakdown of the company’s spending across all areas.

Pros:

Multiple currencies are supported.

Uploading and managing receipts

Spending management

Management of reimbursements

Cons:

Unaffordable price

5) Emburse Spend

With Emburse Spend, you get a sophisticated, complete, centralized platform that allows you to manage your employees’ spending effortlessly. The software gives you total real-time visibility into your team’s spending, and you have the authority to assess and approve expenditure requests.

For example, you can set a maximum budget for recurrent expenses, which allows you to avoid overspending. Emburse Spen also allows quick, automatic reconciliation by capturing expense details directly at the point of transaction.

Pros:

Real-time access to complete spending insights.

Auto-reconciling receipts simplifies bookkeeping.

Reconciliation is done automatically.

Control spending by location, spending limitations, and location.

Cons:

Difficulty in creating one-time, restricted virtual cards.

6) Emburse Certify

Emburse Certify is an all-in-one company and personal expense management software that gives businesses more control and visibility over their spending. Employers can use the program to compile expense reports more quickly and accurately. It speeds up the entire approval process and significantly minimizes reimbursement delays.

Because of its mobile-friendly interface, using the software is exceedingly straightforward. It is extremely simple to photograph receipts and email them for quick approval. Plus! The program also enables managers to establish pre-approval standards, which speed up the approval process and regulate business spending. It makes budget decisions easier by offering detailed information on a company’s day-to-day spending. The solution now supports over 140 currencies and allows processing in 64 languages.

Pros:

Create expense reports automatically

Pre-set compliance policy for quick approvals

Integration with various supporting software

Support for 140 currencies and 64 languages

Cons:

Not a user-friendly software

Conclusion

A corporation must understand where and by whom its finances are being spent. Inadequate d ta at a company’s expense might lead to disastrous consequences. This is where expenditure management software can help.

These solutions exist only to simplify and automate the otherwise difficult and time-consuming expenditure management process. Expense repo t software is essential for businesses to compete and prosper in today’s competitive climate, from receipt management and expense report submission to optimizing processes and getting comprehensive analytical results. Saasbery sta f provides thorough consulting on the SaaS platform your organization requires. So, if you are looking for a SaaS platform for your company, call us. Our experts can assist you in reaching the correct audience.

FAQs

Which tool do I use to keep track of your business expenses?

Expensify is a web-based expense management tool that tracks and controls your spending in real-time. You may easily make expenditure reports and submit them. The system also includes an automatic repayment system that directs the approved amount to employees’ bank accounts.

How does one go about automating an expenditure report?

Here’s how easy it is to create automated expense reports using Spendesk.

Your team members will pay for what they require.

They launch the Spendesk app (mobile or desktop) and choose Make a new request.

They click Submit an Expense and attach their receipt.

Spendesk can read the receipt and extract the relevant information.

Which app is the best for tracking expenses?

Apps for tracking expenses

Mint is the best free app overall.

Goodbudget is the best program for beginners.

You Need a Budget is the best app for serious budgeters (YNAB)

QuickBooks Online is the best program for small company owners.

Expensify is the best app for tracking business expenses.

Which accounting software is the most effective?

2022’s Best Accounting Software

Zoho Books is the best option for Zoho users.

FreshBooks is the best option for ease of use.

Xero is the best option for advanced features.

Intuit QuickBooks is the best accounting software for freelancers.

NetSuite is the best automation software.

Sage Business Cloud Accounting is ideal for small businesses.

Excellent for Self-Employed.

Kashoo is ideal for startups.