The Ultimate Guide to Choosing the Best Tax Software

Many people and organizations will soon have to deal with the difficult chore of filing their tax returns as tax season draws near. Because tax laws and regulations are so complex, having trustworthy tax software is essential to making the process easier and guaranteeing accuracy. This thorough guide will cover all you need to know to select the finest tax software, including what features to look for and how to compare popular options, reviews, advice, and upcoming trends.

Things to Take Into Account While Selecting the Best Tax Software

Tax Situation Complexity:

Assess the complexity of your tax situation, including income sources, deductions, and credits, to determine the software’s required capabilities.

Choose software that can handle your specific tax scenario, whether you have simple tax returns or more complex financial situations involving investments, rental properties, or self-employment income.

User-Friendliness:

Look for software with an intuitive interface and clear guidance to seamlessly navigate the tax preparation process.

Consider whether the software offers step-by-step instructions, explanations of tax terms, and prompts to help you accurately report your income and claim deductions.

Pricing:

Evaluate the software’s pricing structure and compare the cost with the value it offers, considering any additional fees or upgrades required.

Determine whether the software offers a free version for simple tax returns or if you need to pay for more advanced features, such as live expert support or audit assistance.

Integration and Import Capabilities:

Software that can easily import tax-related data or interface with your current financial program should be considered.

Seek functionality to import W-2s, 1099s, and other tax records into the program. This will help you save time and lower the possibility of data entry errors.

Consider whether the software can automatically import pertinent financial data for tax filing by syncing it with your bank accounts, investment accounts, and other financial platforms.

Top Features to Look for in Tax Software

Comprehensive Tax Coverage:

Ensure the software covers all relevant tax forms and schedules for your specific situation, including federal, state, and local taxes.

Look for software that accommodates various tax scenarios, such as income from multiple sources, itemized deductions, and investment income.

Error-Checking and Audit Support:

Choose software with built-in error-checking features to identify potential mistakes or discrepancies in your tax return.

Look for audit support services that provide guidance and assistance if the IRS or state tax authorities select your tax return for audit.

Tax Planning and Optimization:

Some software offers tax planning tools to help you maximize deductions and credits, potentially saving you money on your tax bill.

Look for features such as tax calculators, scenario analysis, and optimization suggestions to ensure you’re taking advantage of all available tax breaks.

Customer Support:

Assess the caliber and accessibility of the software provider’s customer support services.

Search for online resources where you can get answers to frequently asked topics, such as user forums, knowledge bases, and FAQs.

Consider whether the program provides live support—such as phone or chat support—or access to tax experts for individualized help with questions or concerns about taxes.

Comparison of Popular Tax Software Options

Price:

TurboTax:

Offers various pricing tiers, ranging from free for simple returns to higher prices for more complex tax situations.

H&R Block:

Provides a range of pricing options, including free filing for basic returns and paid versions for more advanced features.

TaxAct:

It is known for its affordability and competitive pricing compared to other tax software options.

TaxSlayer:

Offers affordable pricing with different tiers to accommodate various tax situations.

FreeTaxUSA:

It stands out for its free federal filing option, which makes it a cost-effective choice for individuals with straightforward tax returns.

Ease of Use:

TurboTax:

Renowned for having an easy-to-use interface and providing step-by-step instructions appropriate for novice and expert users.

H&R Block:

Offers a straightforward filing process with intuitive navigation and helpful guidance throughout.

TaxAct:

Provides an easy-to-use platform with interview-style questions and explanations to simplify the tax filing process.

TaxSlayer:

Includes an intuitive user interface with prompts and clear instructions to help consumers finish their tax returns.

FreeTaxUSA:

It offers a simple and intuitive interface for entering tax information, making it easy for users to file their taxes accurately.

Features:

TurboTax:

It provides many features, such as importing W-2s and prior tax returns, live professional support, and maximum refund guarantees.

H&R Block:

It provides features like importing tax documents, free audit support, and access to tax professionals for assistance.

TaxAct:

Features include real-time refund tracking, prior-year tax return import, and accuracy guarantees.

TaxSlayer:

Offers free e-filing, data import from previous tax returns, and deduction finders.

FreeTaxUSA:

Provides features such as free e-filing, data import from previous tax returns, and audit assistance.

Support Options:

TurboTax:

Provides a range of assistance channels, including phone help, community forums, live chat, and access to tax professionals.

H&R Block:

Provides support through live chat, phone support, and in-person assistance at H&R Block offices.

TaxAct:

It offers support through email and phone, with additional resources on its website.

TaxSlayer:

Provides support through email and phone and an extensive knowledge base for self-help.

FreeTaxUSA:

Offers support via email, with detailed FAQs and help articles available on their website.

Refund Options:

TurboTax:

Offers options for direct deposit, paper check, or prepaid debit card for receiving tax refunds.

H&R Block:

Provides direct deposit, check, or Emerald Prepaid Mastercard options for receiving refunds.

TaxAct:

Offers direct deposit or check as refund options for tax filers.

TaxSlayer:

It provides options for direct deposit or check to receive tax refunds.

FreeTaxUSA:

Offers direct deposit or check as refund options, with no additional fees.

Tips for Maximizing Your Tax Software Experience

Gather All Necessary Documents:

Before starting your tax return, ensure you have all relevant tax documents, such as W-2s, 1099s, and receipts, organized and readily available. This will streamline the process and help you avoid delays or errors.

Update Software and Operating System:

Update your operating system and tax software to guarantee compatibility, access to the newest features, and compliance with changes in tax legislation. Regular updates can also enhance security and performance.

Back-Up Your Data:

Regularly back up your tax return data to prevent loss and facilitate easy retrieval. Consider saving backup copies to external devices or cloud-based solutions for added security.

Take Advantage of Help Resources:

To handle any queries or problems throughout the tax preparation process, use the software’s community forums, tutorials, and built-in help tools. Numerous tax software suppliers provide extensive online support to help customers with routine chores and issues.

Pros and Cons of Using Tax Software

Pros:

Accuracy and Error Reduction:

Tax software helps minimize errors by automatically calculating and flagging potential mistakes, leading to more accurate tax returns.

Time-Saving Automation:

Tax software automates repetitive tasks, such as data entry and form completion, saving users time and effort during tax preparation.

Comprehensive Tax Coverage:

Many tax software programs cover various tax forms and schedules, including federal, state, and local taxes, ensuring thorough tax reporting.

Potential Cost Savings:

Tax software can be more cost-effective than hiring a professional tax preparer, especially for individuals with simple tax situations.

Cons:

Upfront Software Cost:

Some tax software programs require an upfront purchase or subscription fee, which may deter users who prefer free or low-cost options.

Potential for User Error:

Users may still make mistakes during tax preparation, despite built-in error-checking features, leading to inaccuracies or audit risks.

Limited Suitability for Complex Tax Situations:

Tax software may not be suitable for individuals with highly complex tax situations, such as business owners with multiple revenue streams or investors with diverse investments.

Dependence on Software Updates and Support:

Users rely on timely software updates to ensure compliance with changing tax laws and regulations. Additionally, dependence on software support for assistance with technical issues or inquiries may be frustrating for some users.

Security Measures in Tax Software

Tax software often incorporates security measures to protect users’ sensitive financial information. Here are some common security features found in tax software:

Data Encryption:

Tax software often uses strong encryption methods to protect users’ financial and personal information both during transmission and storage. This encryption guarantees data security and unauthorised party access.

Multi-Factor Authentication (MFA):

Multi-factor authentication (MFA) is available on several tax software platforms as an extra security measure. Before gaining access to their accounts, MFA users must submit several types of verification, such as a password and a special code sent to their mobile device.

Secure Login Credentials:

Tax software encourages users to create strong, unique passwords for their accounts to prevent unauthorized access. Some platforms enforce password complexity requirements and periodically prompt users to update their passwords for added security.

Firewalls and Intrusion Detection Systems (IDS):

Tax software suppliers use firewalls and intrusion detection systems to monitor network traffic and identify and stop illegal access attempts and suspicious activity. These security precautions help defend against outside threats and unlawful access.

Regular Security Audits and Compliance:

Tax software companies often undergo regular security audits by independent third-party assessors to ensure compliance with industry standards and regulations. Compliance with standards such as SOC 2 (Service Organization Control) and ISO 27001 demonstrates a commitment to maintaining robust security practices.

Secure Data Centers:

Customers of tax software providers may keep their data in safe, modern data centers with physical security features like biometric access controls, surveillance cameras, and round-the-clock monitoring. These data centers are built to withstand natural disasters and theft, among other physical hazards.

Privacy Policies and Data Protection:

Most tax software providers have privacy policies that describe how they gather, handle, and safeguard the personal data of their users. Users should check these rules to learn how their data is handled and what safeguards are in place to protect their privacy.

Future Trends in Tax Software Development

Explore emerging trends in tax software development, such as:

Cloud-Based Solutions:

Since cloud-based tax software solutions are accessible, scalable, and flexible, they are growing in popularity. Users can collaborate and work remotely more easily by accessing their tax data from any internet-connected device. Furthermore, cloud-based solutions ensure customers can access the most recent tax rules and regulations by providing automatic updates and data backups.

Artificial Intelligence and Machine Learning Integration:

Tax software developers are incorporating artificial intelligence (AI) and machine learning (ML) algorithms to improve tax compliance, optimize tax planning, and enhance the user experience. AI-powered features can analyze vast amounts of financial data, identify patterns, and recommend maximizing deductions and credits. Machine learning algorithms can also automate data entry, error detection, and tax form completion, saving users time and reducing the risk of errors.

Mobile Compatibility and Apps:

With the increasing use of smartphones and tablets, tax software developers focus on mobile compatibility and develop dedicated mobile apps for tax preparation. Mobile apps allow users to file their taxes on the go, capture and upload tax-related documents using their cameras, and receive notifications about important tax deadlines and updates. Mobile-friendly interfaces and intuitive navigation make tax preparation more accessible and convenient for users.

Blockchain and Distributed Ledger Technology:

Distributed ledger technology (DLT) and blockchain offer a transparent, unchangeable record of financial transactions that might completely transform tax compliance and reporting. Tax software developers are investigating blockchain technology as a potential tool for automated tax reporting, real-time audits, and secure data storage. Blockchain-based solutions lower the possibility of fraud and manipulation in tax procedures while increasing compliance, accuracy, and transparency.

Best Tools/software for Tax Software

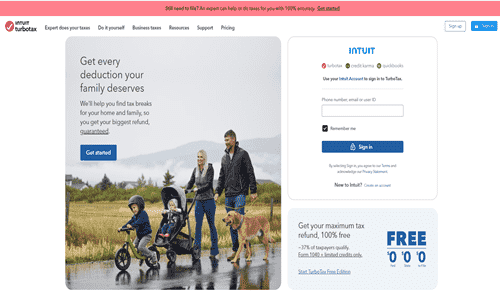

TurboTax

TurboTax is one of the most widely used tax preparation programs for individuals and small businesses.

It provides step-by-step instructions and an easy-to-use interface to help you file taxes effectively.

Offers several versions, including Basic, Deluxe, Premier, and Self-Employed, to accommodate varying tax circumstances.

It offers features like live tax expert support, the import of W-2s and previous tax returns, and maximum refund guarantees.

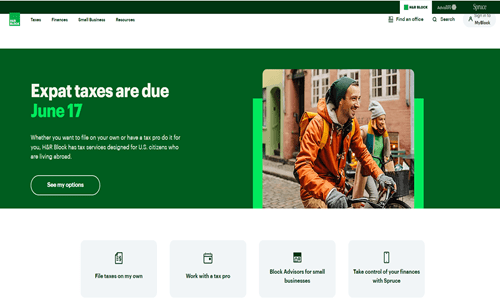

H&R Block

H&R Block offers various tax preparation options, such as desktop and internet software and in-person tax filing services.

Provides a simple, guided process for entering tax information and maximizing deductions.

Offers features like tax document import, free audit support, and access to tax professionals for assistance.

Suitable for individuals, freelancers, and small business owners.

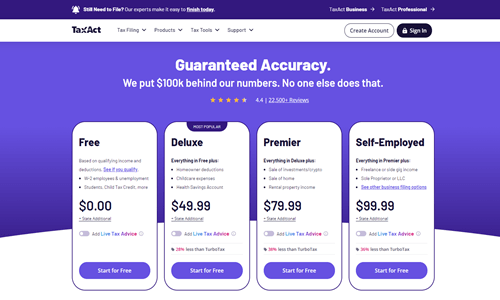

TaxAct

TaxAct is known for its affordability and comprehensive tax preparation tools.

Offers different versions tailored to individual taxpayers, freelancers, and small business owners.

It provides a user-friendly interface with interview-style questions to help you accurately report your income and deductions.

Features include real-time refund tracking, prior-year tax return import, and accuracy guarantees.

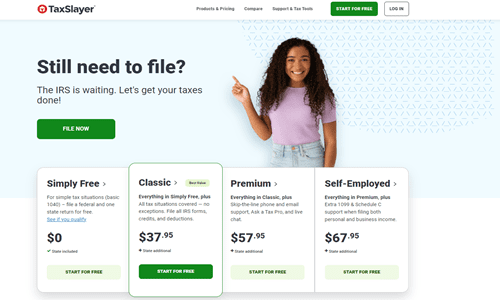

TaxSlayer

TaxSlayer offers both online and downloadable tax software solutions at competitive prices.

It provides a range of features, including free e-filing for simple returns, data import from previous tax returns, and deduction finders.

Provides a user-friendly interface with detailed instructions to guarantee accurate filing of taxes.

Perfect for people on a budget, families, and small business owners searching for reasonably priced tax preparation services.

FreeTaxUSA

FreeTaxUSA provides free federal tax filing services for simple tax returns.

It offers a straightforward interface with easy-to-follow instructions for entering tax information.

Provides features like free e-filing, data import from previous tax returns, and audit assistance.

Ideal for individuals with uncomplicated tax situations who prefer a no-frills, cost-effective tax filing option.

Credit Karma Tax

Credit Karma Tax offers free online tax filing services for individuals, covering various tax situations.

Offers a straightforward and user-friendly interface for submitting tax data and claiming deductions.

Provides services such as free electronic filing, tax document import, and assistance with audit defense.

They are integrated with Credit Karma’s other financial tools, allowing users to manage their finances comprehensively.

TaxJar

TaxJar specializes in sales tax automation for e-commerce businesses, helping them accurately calculate and file sales tax.

Provides integrations with various e-commerce platforms, making it easy to sync sales data and calculate tax liabilities.

Offers features like automated sales tax filing, nexus detection, and multi-state tax management.

Ideal for online sellers and businesses looking to streamline their sales tax compliance process.

Drake Tax

Drake Tax is a comprehensive tax preparation software for tax professionals and accounting firms.

Provides comprehensive form coverage, sophisticated tax planning tools, and adjustable features to satisfy the demands of tax experts.

Provides features like bulk import of tax data, e-filing for federal and state returns, and client management tools.

Suitable for tax professionals handling complex tax situations and serving a large client base.

Jackson Hewitt Online

Jackson Hewitt Online offers online tax preparation services for individuals, with options for simple and complex tax situations.

Supports a guided tax preparation process from tax professionals for assistance.

Offers features like import of tax documents, accuracy guarantees, and refund advance options.

Ideal for individuals seeking personalized tax assistance and support during the filing process.

Liberty Tax Online

Liberty Tax Online offers online tax filing services for individuals and small businesses, with options for different tax situations.

It provides a user-friendly interface with step-by-step guidance to help users accurately report their income and deductions.

Offers features like free e-filing, live chat support, and access to tax professionals for assistance.

Suitable for individuals, families, and small business owners seeking affordable and reliable tax preparation solutions.

FAQs

Can tax software handle self-employment or rental property income?

Many tax software options have dedicated sections or modules for handling self-employment, rental property, and other business-related income sources. However, it’s essential to check the specific software’s capabilities and ensure it meets your needs.

Do I need to purchase tax software every year?

To guarantee compliance with the most recent tax rules and regulations, most tax software vendors either require the purchase of a new version annually or offer annual subscriptions. Some software, nevertheless, might provide lifetime or multi-year licenses.

Can tax software import data from previous years?

Many tax software options allow you to import data from previous years’ returns, streamlining the process and reducing the need for manual data entry. However, this feature may vary across different software providers.

How do tax software programs handle state and local taxes?

Most major tax software programs offer state tax preparation and filing capabilities as part of the base package or as an additional purchase. Some also support local taxes, but coverage may vary depending on your location.

Can tax software handle complex situations like investments or cryptocurrency?

While most tax software can handle basic investment scenarios, more complex situations involving extensive portfolios, alternative investments, or emerging asset classes like cryptocurrency may require specialized software or professional assistance.

Are there any free tax software options available?

Yes, several free tax software options are available, such as Credit Karma Tax, TaxSlayer Simply Free, and the IRS Free File Program. However, these free options often have income or form limitations and may need more advanced features found in paid software.

Conclusion

Choosing the best tax software can significantly streamline tax preparation, ensuring accuracy and maximizing potential deductions and credits. You can select the software that best meets your needs by considering factors like tax situation complexity, user-friendliness, and top features. Remember to prioritize security measures and stay informed about future trends in tax software development. With the right tax software and preparation, you can confidently navigate the tax season and save time and money.