How to Start A Venture Capital Fund? Explained Step-by-Step Complete Guide & Process

If you wish to become a new management looking to launch a venture capital company and raise money? Do you believe you possess the knowledge and abilities necessary to identify prospective early-stage businesses with a “venture rate of return”? Next, before soliciting money for your venture capital fund and starting to write checks, you’ll need to set up a management business in charge of overseeing the operations of the VC firm.

What Is A Venture Capital Fund?

Let’s first define what a venture capital fund is before we move on. In order to find investment possibilities for startup companies with strong long-term growth prospects, a pooled investment fund (a subset of private equity) seeks money from numerous investors (limited partners). When a company is formed through an IPO, merger, or acquisition, the objective is to generate a profit for investors.

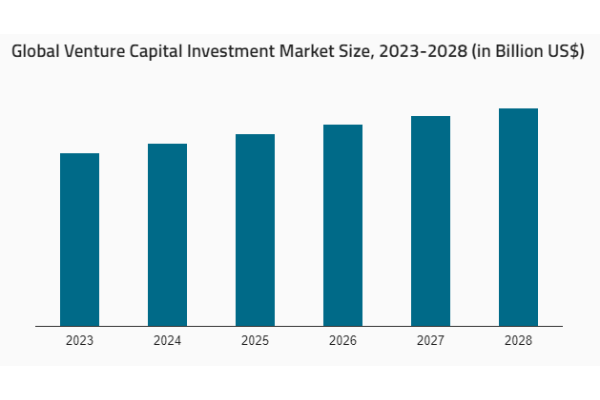

In 2022, the size of the global venture capital investment market was US$ 233.9 billion.

Looking ahead, IMARC Group projects that the market will increase at a compound annual growth rate (CAGR) of 21.75% from 2023 to 2028, reaching US$ 708.6 billion.

Source- IMARC Group

The general partners (GPs), who are venture capitalists and investors, frequently take an active role in the portfolio firms they invest in by sitting on boards, giving strategic counsel, setting up meetings, and facilitating the acquisition of new cash. Investments at the pre-seed stage can range from $5 million to $15 million, while later-stage investments can exceed several hundred million dollars.

This blog post covers and helps fund managers in setting up their management company, comprehending the business model, and raising money for their existing fund for venture capital.

How to launch a venture capital fund in detail

Create a reputation or possess an advantage

If you don’t have a history of profitable investments, it will be difficult to attract limited partners ready to put their money into your venture.

Therefore, before creating a VC fund, it is imperative to gain experience in the venture capital ecosystem or invest your own money as an angel investor. You will have the ability to gain knowledge of the processes and how to benefit your limited partners (LPs) and portfolio companies. This is also where you’ll build your network. In venture capitalism, relationships are crucial. It is useless to start a VC fund unless you have a substantial network.

If you are an operator (previous entrepreneur, executive, or subject matter expert) who can provide useful advice and utilise your professional networks to fundraise and assist early-stage founders, we advise you to collaborate with a “financial” VC or someone with experience with institutional finance.

Step-By-Step guide To Start A Venture Capital Fund

Your Investment Search: Specify

The venture capital sector is a small, close-knit one that is incredibly competitive. You’ll need to provide something novel in terms of your investing strategy to persuade LPs and future employers will seriously consider you. Creating an investing thesis aids in brand definition and serves as a crucial fundraising tool for your fund.

You need to revise and iterate your argument when you establish your fund and begin to raise money. Your venture firm’s launch, your research, and the raising of your first capital will all have a significant impact on your investing thesis.

According to experts, you should format your investing thesis as follows:

(Fund Name) is establishing a ($xMM) (stage) venture fund in (location) to offer financial assistance to (geography) (sector/Market Companies) (secret sauce).

Making Investment Decisions

The primary duty of the investment decision-maker is to allocate funding for the project or program. The position serves as a symbol of top management’s dedication to the project or program and the standards of regularity, propriety, and cost-effectiveness. Allocating financial resources is referred to as an investment choice. Based on risk tolerance, investment goals, and expected returns, investors select the assets or investment possibilities that best meet their needs.

Due to the limited financial resources available to businesses, top-level management allocates funds to long-term assets and creates capital budgets. Short-term investments are chosen by managers in charge of running a business to ensure liquidity and working capital. The frequency of returns, related risks, maturity times, tax advantages, volatility, and inflation rates all have an impact on investment decisions.

How will you decide which investments to make? What elements will determine the values of the companies? Will you make additional investments in the future? It would be ideal to have all of these issues considered before formally beginning discussions with your partners.

Creating A Process For Due Diligence

Even though establishing your company, legal entities, and all the back-office processes is essential for the success of your fund, as a budding manager, you will devote the majority of your time and energy on fund-raising.

Venture capital funds are typically organised as limited partnerships. The general partner controls the money that the limited partners supply. Typically, the management business where the general partner works is a separate legal entity. This legal company must be established before you can begin fundraising and setting up meetings with prospective portfolio companies.

It is important to pay attention to the details when creating a limited partnership agreement (LPA), especially those involving substantial risk, such as the fees (management fees, carry, incentive fees, etc.).

It is crucial to have a firm understanding of these costs because they could ultimately affect the performance of the fund and, as a result, the performance for the LPs. To ensure that the fund structuring is tax-efficient and to support you during audits and the fund’s lifetime, a new manager should also speak with a credible accounting partner with experience in venture capital.

Not setting up an LPA and forming the LLC on your own is one of those tasks. It is best to hire a competent attorney to set up these legal corporations for you in order to ensure that everyone is protected. The legal costs related to starting a VC fund could range from $30,000 to more than $200,000 depending on a variety of variables.

Choosing The Best Tech Stack For Venture Capital

Due diligence is an essential component of managing a fund because investing in new enterprises using venture capital is hazardous by definition. You must build a method because amazing DD can be laborious and time-consuming.

Typically, the fund will invest in one of the 10 companies that receive a full evaluation out of every 100 that are assessed.

Every business does due diligence in a different way, and every possible investment requires a different approach. However, the management team, market, product, traction, legal, and financial areas are where the majority of research tends to lie.

You must set up a procedure to gather and analyze this data if you want to be efficient during the process. You can conduct the research all by yourself, employ a helper to put together reports. Any employer you choose will require these reports, so create a method that doesn’t consume a good amount of considerate time.

Conclusion

You most likely won’t have the funding available when starting your initial fund to hire several personnel. But you’ll be extremely busy raising money, finding, researching, investing in, and also supporting portfolios of firms.

The success of the fund and your productivity both depend on choosing the appropriate technology stack. In terms of software, you ought to implement a CRM procedure in order to standardize, optimize, and automate the process of deal-making. The majority of transactional CRMs, like Salesforce, are made for sales teams that are concentrated on closing deals rather than handling complex venture capital sales.

Selling a product is considerably different from investing in initial stage businesses. Saasbery offers extensive consulting when it comes to the SaaS platform that your company needs. Private consultations can be arranged with one of our experts, who have more than 18 years of experience in the field and employ tactics that have proven effective.

FAQs

Can anyone launch a venture capital firm?

Is a License Required to Invest in Venture Capital? No license is necessary. You must have a good degree of financial industry experience, ideally in investment banking or private equity. Your prospects of becoming a venture capitalist are also improved by having an MBA.

Who is eligible to invest in venture capital funds?

But high net worth investors who are accredited investors — defined as having a net worth of at least $1 million, either alone or with a spouse, or having earned more than $200,000 over the previous two years ($300,000 with a spouse) — can also take part in venture capital funds and direct investments.

How challenging is it to secure Venture Capital money?

It is very difficult to raise money from a venture capital (VC) firm. Only 0.7% of startups receive equity checks from Andreessen Horowitz, and after that, there is only an 8% likelihood of success for your startup. That results in a combined success rate of 0.05%, or 1 in 2000.

How much money is required to make a venture capital investment?

IDG Ventures India has been investing in venture capital for 15 years and has a portfolio of more than 220 firms. Investment structure: $10 million to $1 million is invested.