Best Sources For SaaS Startup Funds in 2025: A Complete Guide

Obtaining funding is an important but frequently difficult stage in the growth and development of a SaaS firm. So, what steps should you take? What form of investment is best for you? When should you start looking for investments, if ever?

Raising money entails giving up your freedom and responding to others; at the absolute least, it involves embarking on a journey different from what you had anticipated regarding growth, returns, and expectations. However, knowledgeable investors will lead you and keep you from committing errors. Thus, should you raise children or not? There is no clear-cut “yes” or” “n” or” re” po” se to the problem, but a typical place to start is by assessing what you already have.

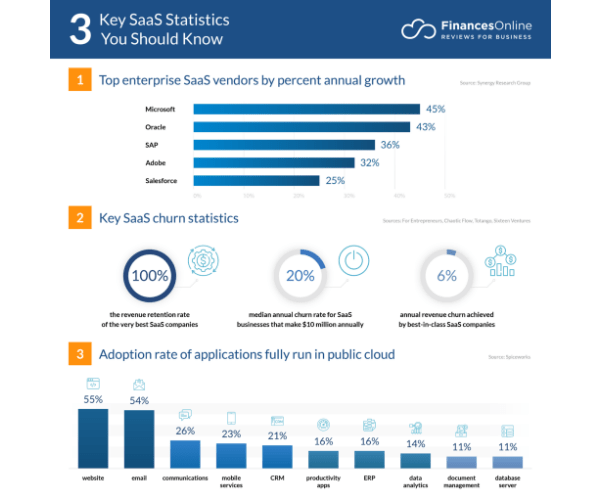

Source- Finance Online

The success rates for Saas startups are lower than the 10% average for new firms. Insightful research by McKinsey & Company indicates that 92% of Saas startups are expanding at 20% p.a. fail within a few years.

7 Funding Sources For Your SaaS Startup Funds

Venture Capitalists

The most common form of funding is venture capital funds. VCs favor funding newly established startups and many different-sized businesses with room for long-term expansion. These VCs could be private investors or hedge funds. Support from venture capitalists (VCs) might also come in technical form, managerial know-how, or assistance.

As per the firm stage to be invested in, three different types of venture capital funds exist.

Financing for startups

Finance for expansion

Purchase financing

Bootstrapping

Bootstrapping is a strategy for business expansion without the aid of outside financial sources. Another way of bootstrapping is by investing in stakeholders or personal funds. This suggests that for a firm to continue growing, the revenue it receives from customers must be put back into its operations.

The following reasons make this an affordable option for founders:

No positions in the stock will need to be given up.

You don’t have exorbitant interest fees on the money you are yoyou’veoyou’veriginating from a position of strength (with less debt on hand), which tends to make business increasingly enticing to lenders and investors when the time comes to take out a loan from outside sources.

Angel Investment

Like venture capital investing, angel investing is an equity financing type where an investor contributes money in exchange for a portion of the firm. However, there is a clear distinction between the two. A person who makes a small investment in a young company or corporation during their early tenure is called an angel investor (as opposed to venture capitalists, which are established businesses). The advantages of raising capital are obvious:

Since angel investors make most of the decisions, getting funding happens quickly.

Most angel investors have prior business background & support the company by offering guidance and useful recommendations.

Also read: Best Electronic Document Management Software

Crowdfunding

Crowdfunding, a comparatively new method of raising money, is competitive. They provide a quick overview of their concept, business idea, and other factors. Visitors to the website who are planning to invest in them select the company they wish to invest in. This method results in SaaS owners receiving a small sum from many sources. Among the factors that entrepreneurs use crowdfunding are:

It serves as an organic marketing campaign with several monthly visits from new audiences and strong donations.

It helps with concept approval and enables crowdsourced brainstorming.

Partner Financing

You must grant exclusive support to the team, product/service, sales, distribution rights, or a mix of these in return for the money collected. If your partner also belongs to the same industry as you or one that complements it and has a stake in your company, this is certainly one of the finest possibilities.

Businesses can save more resources by utilising the other paparty’sparty’srceproducts.

In a partner financing arrangement, you and the partner(s) share ownership of the business and the cocompany’sains.

Convertible Notes

Many new investors prefer to hold off on valuing their company until the subsequent round of funding or a certain milestone. A convertible note is an alternative. It is structured as a debt investment and intends to convert principal and equity interest. Convertible notes also include additional clauses, such as discounts and restrictions, to compensate for the higher risk investors took by investing previously.

It was carried out reasonably quickly.

Due to the lower legal charge compared with other possibilities, it is also less expensive.

Giving investors the price discount, which was decided later, delayed the valuation.

You don’tdon’t to make monthly cash payments because the interest is compounded, and the payments are paid in cash or converted into equity as per the maturity date.

Revenue Based Financing

With this kind of loan, repayment is based on the borrower’s salary rather than a predetermined sum. Businesses also have inventory or account receivables that serve as loan collateral and are frequently eligible for lines of credit. Investors view this recurrent income as a security for the loan amount. SaaS companies can easily get the MRR with a lower CAC and consistent recurring income. Getting this form of finance has several advantages, including:

There is no need for security.

No mandatory monthly principal payments

No valuation is necessary.

Being diligent is simple and quick.

Accelerator Funding

Business accelerator programs are brief training and mentorship initiatives designed to assist early-stage firms in scaling. The duration of the accelerators is fStartupsartups focus only on the company during the program, and each program is different. These initiatives offer seed funding, assets, business contacts, mentoring conductions, and a demo day event as their conclusion.

The advantages of joining an acceleration program include the following:

Get a dedicated time slot for working with professionals and getting the chance to have financial options helping businesses grow swiftly.

Mentoring and direction are provided in private conversations with advisors.

Opportunity for networking with other businesspeople

Conclusion

In conclusion, securing funds for a Software as a Service (startup startup is crucial in bringing innovative ideas to market and scaling operations. Whether through bootstrapping, angel investors, venture capital, or crowdfunding, finding astartuptartup requires strategic planning, persistence, and a compelling vision. By leveraging various funding sources and aligning them with the company’s trajectory, startup startups can fuel innovation, expand their customer base, and ultimately achieve long-term success in the competitive tech landscape. However, securing funds is just the beginning. Startup startups must utilize these resources wisely, prioritize customer needs, iterate on their product offerings, and focus on delivering value to stakeholders. With the right funding strategy and a relentless commitment to innovation, startup startups have the potential to disrupt industries, drive market growth, and build sustainable businesses that thrive in the digital economy.

FAQs

What are startup funds, and how do they work?

Start startup funds refer to capital provided to early-stage software as a service (SaaS) companies to help launch, grow, and scale their businesses. These funds can come from various sources, such as venture capital firms, angel investors, accelerators, and crowdfunding platforms. They are typically invested in exchange for equity or convertible debt istartuptartup.

How can startup startup funds benefit my business?

Startup funds can provide crucial financial resources to start startup costs, develop and improve the product, hire key team members, invest in marketing and sales efforts, and expand into new markets. Additionally, investors often bring valuable expertise, networks, and mentorship to help startups succeed.

What types of startup funds are available?

Several start-up funds are available, including seed funding, venture capital, angel investment, accelerators and incubators, debt financing, and crowdfunding. Each type of funding has its criteria, requirements, and implications for entrepreneurship and growth trajectory.

How do I determine the right type and amount of funding for mystartuptartup?

Determining the right type and amount of funding for your start-up depends on factors such as your business model, stage of development, growth goals, market opportunity, and capital needs. To make informed decisions about funding options, conducting thorough research, creating a detailed business plan, and seeking advice from mentors and advisors is essential.

What criteria do investors look for when considering startup funding?

Investors typically evaluate based on factors such as the strength of the founding team, market opportunity and competitive landscape, product differentiation and scalability, customer traction and revenue growth, business model and monetization strategy, and potential for long-term profitability and return on investment. To attract investor interest, startup startups should focus on demonstrating traction, scalability, and a clear path to profitability.